The remittance industry plays a significant role in Cameroon’s economy, providing various benefits to individuals, families, and the country as a whole. In this blog, we will explore the importance of the remittance industry in Cameroon, the benefits it brings, and how it contributes to economic development and financial inclusion.

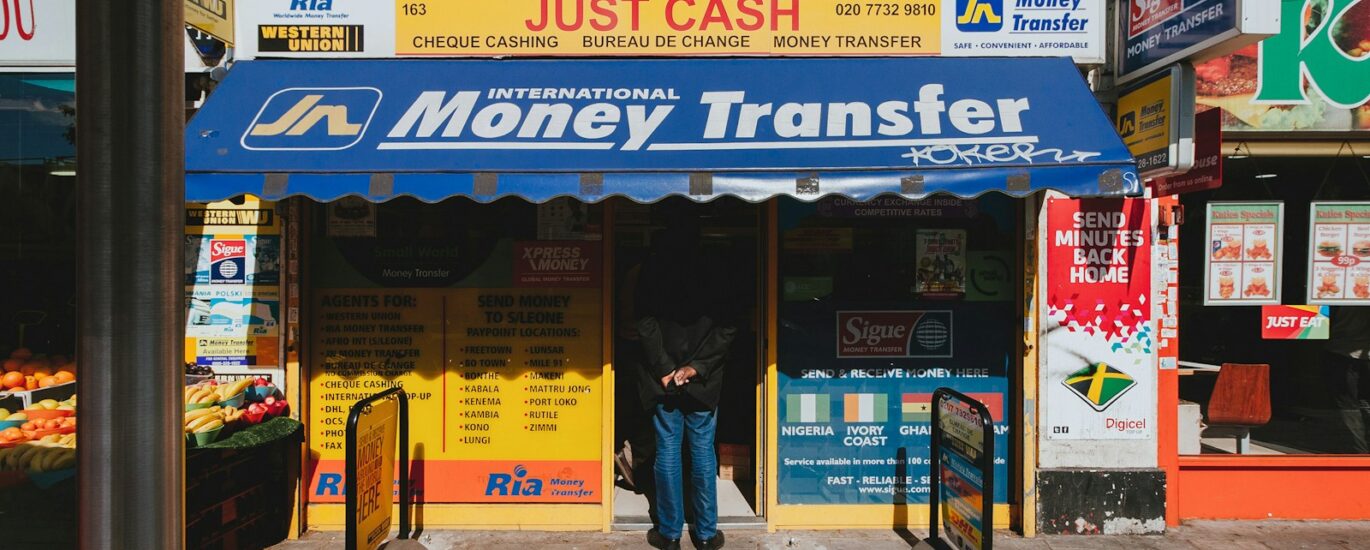

Remittances refer to the money sent by individuals working abroad to their families or relatives in their home country. In Cameroon, remittances play a crucial role in supporting households, improving livelihoods, and fostering economic growth. Many Cameroonians work in countries such as France, the United States, the United Kingdom, and other Asian and African nations, sending money back home to support their families.

Benefits of the Remittance Industry in Cameroon

- Poverty Alleviation: Remittances serve as a lifeline for many families in Cameroon, especially in rural areas where access to formal financial services is limited. The money sent by migrant workers helps alleviate poverty, improve living standards, and meet basic needs such as food, education, and healthcare.

- Economic Stability: Remittances contribute to economic stability by providing a steady source of foreign exchange inflows. The money sent by Cameroonians working abroad boosts the country’s foreign exchange reserves, strengthens the local currency, and supports the balance of payments.

- Financial Inclusion: The remittance industry plays a crucial role in promoting financial inclusion in Cameroon. Many remittance recipients do not have access to formal banking services, and remittance providers offer convenient and affordable ways for individuals to receive and access funds, such as mobile money services and agent networks.

- Investment and Entrepreneurship: Remittances enable families in Cameroon to invest in small businesses, agriculture, education, and other income-generating activities. The money sent by migrant workers can help create employment opportunities, stimulate economic growth, and contribute to local development projects.

- Social Development: Beyond the economic benefits, remittances also have social impacts in Cameroon. The financial support from migrant relatives fosters social cohesion, strengthens family bonds, and promotes human development. Families receiving remittances may have improved access to education, healthcare, and other essential services, leading to better social outcomes and well-being for individuals and communities.

Timezone Financial Corporation Impact

While the remittance industry in Cameroon brings significant benefits, it also faces challenges that can affect the efficiency and impact of remittance flows. Some challenges include high transaction costs, exchange rate risks, limited financial infrastructure in rural areas, and regulatory barriers that can hinder the flow of remittances.

To address these challenges, we at Timezone Financial Corporation Ltd have identified opportunities for innovation and collaboration in the remittance industry. For example, we leverage digital technologies can help reduce transaction costs, increase transparency, and improve the speed and convenience of remittance transfers. We have developed strong local and international Partnerships between financial institutions, fintech companies, and mobile operators to enable the expansion of access to formal financial services and promote financial literacy among remittance recipients.

Policy Recommendations for Supporting the Remittance Industry

To maximize the benefits of the remittance industry in Cameroon, policymakers can consider the following recommendations:

- Reduce Transaction Costs: Implement policies and regulations that promote competition among remittance providers and reduce transaction costs for senders and recipients. Lowering fees and improving exchange rate transparency can help maximize the impact of remittance flows.

- Enhance Financial Inclusion: Expand access to formal financial services for remittance recipients through innovative products and services, such as mobile banking, agent networks, and digital payment platforms. Financial education programs can also empower individuals to make informed financial decisions.

- Strengthen Regulatory Framework: Ensure a conducive regulatory environment that supports the formalization and transparency of remittance flows. These should not discourage investors but rather instill confidence in the sector and attract an appetite for investment.